Our digital onboarding customer case study shows how we used our software solutions to implement a fully digital customer experience and automated credit decisions in just a few steps.

The KT Bank is a mid-sized private bank operating nationwide. Its product portfolio is aimed at customers from the B2B and B2C sectors. In addition to traditional account models, it includes financing solutions for consumers, motor vehicles, real estate and various investment products. The bank’s existing software system was based on a core banking system that it had developed itself.

Among the digital solutions already in place, the bank included a partially digital account opening process as well as product-specific “online applications” in the form of multi-page download forms. These needed to be submitted on paper by the customer either at the branch or by mail to complete the application.

The processing of an application, including identity and credit checks, was carried out manually by a clerk and took around 5 working days before the contract was accepted. The number of new customers was low.

In addition to strengthening its own competitiveness, the KT Bank’s requirements included the introduction of an end-to-end digital application process with automated decision-making and activation or disbursement.

The KT Bank’s most important goals were higher conversion rates and optimization and standardization of the credit process. On top of that, it wanted to reduce the workload of its own employees and speed up the entire application process for each of its financing solutions.

The bank’s biggest challenges included a lack of IT resources and interfaces for project implementation as well as high regulatory requirements.

The application process was slowed down by a high level of manual work resulting from regulatory requirements (compliance with the Money Laundering Act, written form requirement). Day-to-day operational workloads limited the bank’s innovative strength and, among other things, reduced the time to market for new products.

Nezir Erdogan

Head of Digital Banking & Product Management at the KT Bank

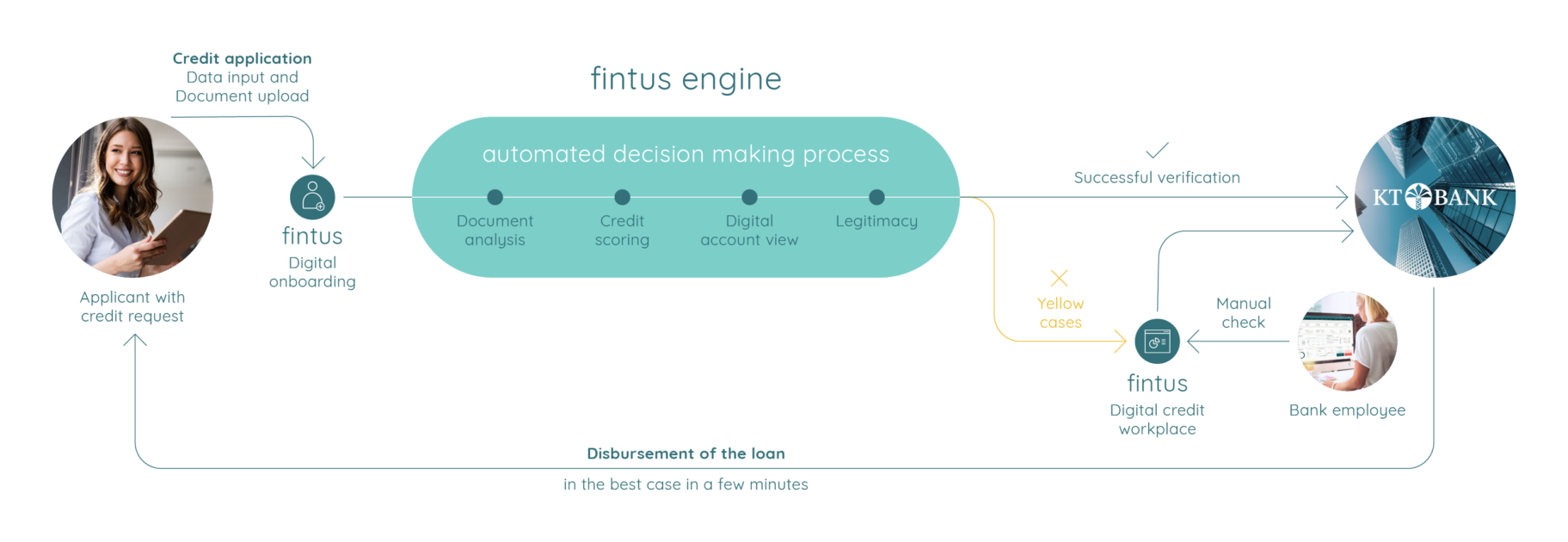

We introduced the standardized digital onboarding process from fintus, which enables the bank to fully digitize and automate the application process.

Flexible product configuration within the fintus engine maps all financing solutions for the business environment and at the same time fulfills the regulatory requirements of the respective product. The central set of rules of the fintus Engine is responsible for triggering the automated credit decisions.

In this way, already during the application process, the prospective customer’s input and data are automatically validated by a logical interpretation in relation to each other.

The application checks and decisions are made by our FinTech partners: digital account view, customer scoring, credit check, identity check and digital signature.

This resulted in a fully digital customer experience, including an automated credit decision, in just a few steps.

With the digital onboarding from fintus, creditworthiness and identity checks are carried out digitally and within a matter of seconds by our FinTech partners.

All applicants with unsuccessful credit requests (yellow cases) are routed to the case processing department at the digital credit workstation. This simplifies customer care and the internal distribution of tasks, and is used to manage and execute day-to-day business, including the display of all application data, rejection reasons, documents and information from third-party sources.

The digital workplace brings all information together in one interface, so that the employee always has an overview of all customer data.

Standardized processes and information allow the operator to make individual case decisions in a split second – and at the same time enable the highest possible process reliability and documentation. Flexibly adaptable processes and rules can be quickly rolled out.

The fintus platform runs upstream of the bank’s IT systems. This means that IT effort is virtually zero. Successful applications are only transferred to the core banking system after the contract has been confirmed.

Completely paperless application processing

Originally 5 days processing time for an application now run fully automated

Resource savings of up to 80 % in application processing

Thanks to the successful implementation of the initial “digital application path” project and the resulting savings in resources, the bank was able to launch an innovative proprietary product on the market more quickly.

The successful process optimization and the reliable collaboration have convinced the KT Bank, so that a continued cooperation to expand the product range is planned.