Discover how to optimize your commercial lending, conserve your own resources and achieve increased customer satisfaction.

Small and medium-sized enterprises (SMEs) frequently have a short-term need for liquidity to provide working capital, or support investments and business succession. The process from initial contact to receiving a conditional offer from the bank can often take days. Final acceptance or rejection typically takes weeks and involves seemingly endless admin and a lot of paperwork for both sides. With the fintus Suite, financial institutions automate the entire application process, including the credit decision itself and any necessary legitimation and acceptance of conditions. Our process automation and digitization gives financial institutions the competitive edge they urgently need.

In Germany, there are more than 3.5 million small and medium-sized enterprises (SMEs) with annual revenues up to EUR 50 million. They account for over 99% of all German companies, generate annual sales of over seven billion euros and more than two billion euros in profits. SMEs form the backbone of the German economy, and their specific needs and demands make them a highly interesting target group for banks. At the smaller end of the scale, SMEs with annual revenues of less than EUR 5 million – such as craft businesses, agencies or the self-employed – are often confronted by the need for liquidity in particular, which is generally provided by short-term loans.

Getting hold of the cash they need is often a cumbersome and bureaucratic process for many SMEs, of whatever size. They need to visit the bank in person, provide proof of the health of the business and deal with the idea of being in debt. The net result is that SMEs simply look elsewhere for liquidity leaving the banks missing the opportunity to make a good sale.

The traditional application process leading up to confirmation and payment of the loan amount is lengthy and notoriously opaque.

Legitimation, transmission of documents and evidence, and the subsequent credit scoring all take a lot of time, which many companies simply don’t have. The lack of opportunities to cooperate digitally with their bank makes many SME customers question the bank’s commitment to digitizing.

At the same time, the heavy manual workload and low margins mean that small-scale commercial lending is rarely profitable for financial institutions, which in turn makes it a low priority for them. To serve the important SME segment profitably and without frustration, regional and national banks need to fundamentally transform and optimize the loan application and disbursement process.

Where this has been done, speed, customer satisfaction and low costs are making even relatively small loans profitable, while improved risk assessment minimizes the chance of default. This is the ideal – and only – way for banks to remain reliable long-term partners for their SME customers in Germany and Europe.

The low-code fintus Suite makes use of state-of-the-art technologies and processes.

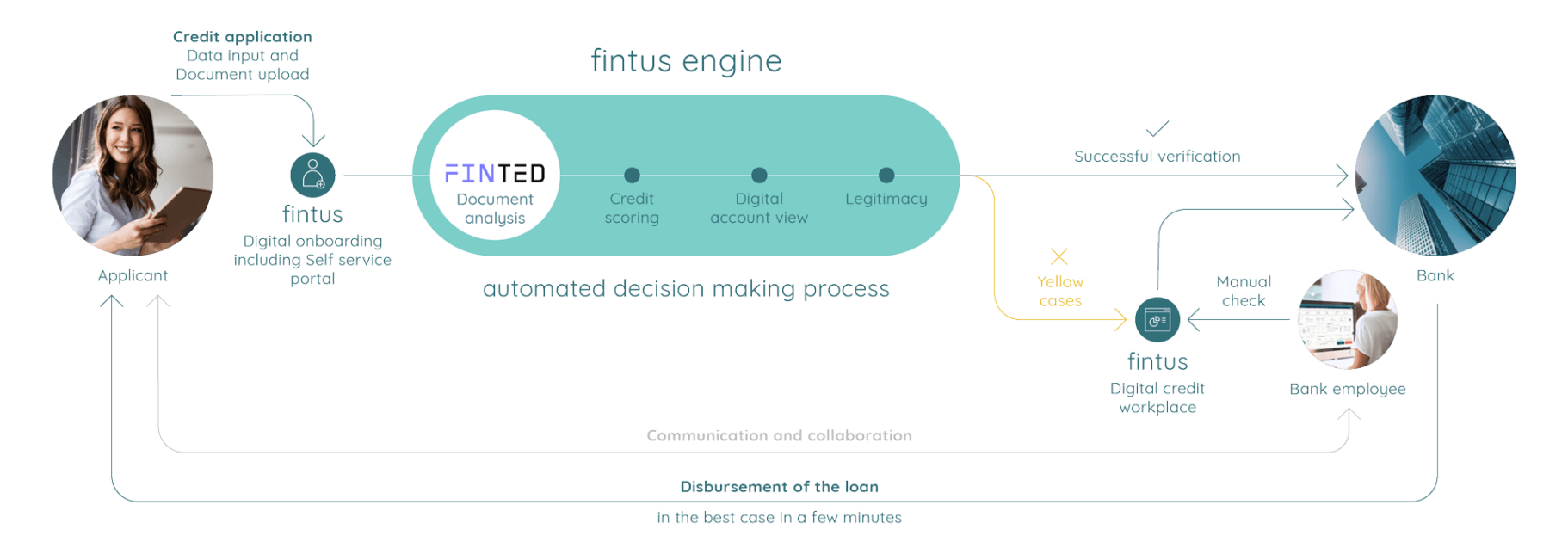

A paperless application process, document analysis and even evaluation to the latest legitimation standards are all fully digitized by the technologies from fintus and our technology partners. You can also adapt the application process to meet your needs and those of your customers, and it all the options for simplified and accelerated loan request processing – without replacing the core banking system.

The fintus Suite means that the credit application can be processed digitally and automatically, right up to the decision.

This can be made within seconds – or, if you prefer, manually by using the fintus Suite digital credit workstation, on a daily basis.

Same-day decisions improve the customer experience, reduce administrative effort, and help applicants obtain the liquidity they need. If the decision is negative or the result triggers upstream processing (what we call “PreCheck”), it will need to be manually processed by a credit expert. He or she gets all relevant information from the fintus digital credit workplace. This includes the applicant’s data, the results of the external credit agencies, the documents supplied, and the analysis result. The most important part of the analyzing why the case was considered necessary for manual processing, what information triggered this, and which options exist for potentially approving the loan.

Data is the key to successful automation.

The applicant’s entries are validated automatically during the application process at field level, as well as by comparing and interpreting the data. External credit agencies, such as Creditreform, Schufa, KYC-Now and Clarilab, supplement this with reliable information that enables the credit scoring to be enriched. Finally, depending on the case, the “digital account view” reduces the risk of fraud, especially for smaller traders.

Submitted documents can be validated with the previously collected and externally enriched data and used for scoring.

The AI technologies of our sister company finted take over the analysis of tax returns, income surplus statements, short-term business management evaluations and balance sheets.

The corresponding set of rules forms part of the scoring model within the fintus Suite.

The key to the system is digital onboarding, including the SelfService portal. This allows users to exchange documents, submit multiple applications in parallel, communicate with each other via messages, start legitimation processes for co-applicants and beneficial owners, and of course sign the contracts. In addition to the initial digital contact and the automated loan decision, future communication, collaboration, and any agreed conditions for the loan during the term of the loan are all handled digitally in a smooth and effective manner.

The fintus SelfService portal enables bank employees to easily request further documents, while the customer can conveniently upload them and hand them over to AI tool for analysis. The SelfService portal is the transparency layer between the prospective customer and the bank.

automated credit decision possible on average up to 90% of all applications

for the customer’s credit application (excl. the request for further information and documents as well as the KYC process)

effort reduction of up to 80% in manual application processing

Thanks to the digital and automated nature of the application process, commercial lending is once again becoming more important for banks. There is less stress on internal resources and the low margins are offset by the reduced effort.

The fast and reliable processing of the request, decision and disbursement increases customer satisfaction and long-term customer loyalty. As well as application reviews and decision-making, other workflows and processes can be digitized and optimized by the fintus Suite.

Almost any repetitive process can be automated using the SelfService portal, together with the fintus digital workplace and intelligent document analysis by finted.