Following the flooding disaster in Ahrtal politicians imposed several support programs. In order to provide the fundings in a timely manner to the victims it was of essence to find a modern solution to process the applications. In a joint project with Investitions- und Strukturbank Rheinland-Pfalz (ISB), SKS Solutions, WebID and FinTecSystems, fintus was able to contribute their part to the disaster support. The project was implemented in less than four weeks.

Seeing pictures of the flooding disaster in Ahrtal was moving. Whole houses and bridges were washed away, people lost their homes and fought to survive. This once in a century flooding mobilised the nation and saw many volunteers coming into the affected region to stand in solidarity with the victims.

Also, the government promised easy and fast financial support for the affected people and communities. The Bundestag approved aid of around 30 billion euros for reconstruction, including 15 billion euros for Rheinland-Pfalz.

Since September 27, 2021, the aid can be applied for at the ISB. In order to speed up the bureaucratic act of processing applications and thus releasing the urgently needed financial resources as quickly as possible, a completely digital and paperless solution was sought.

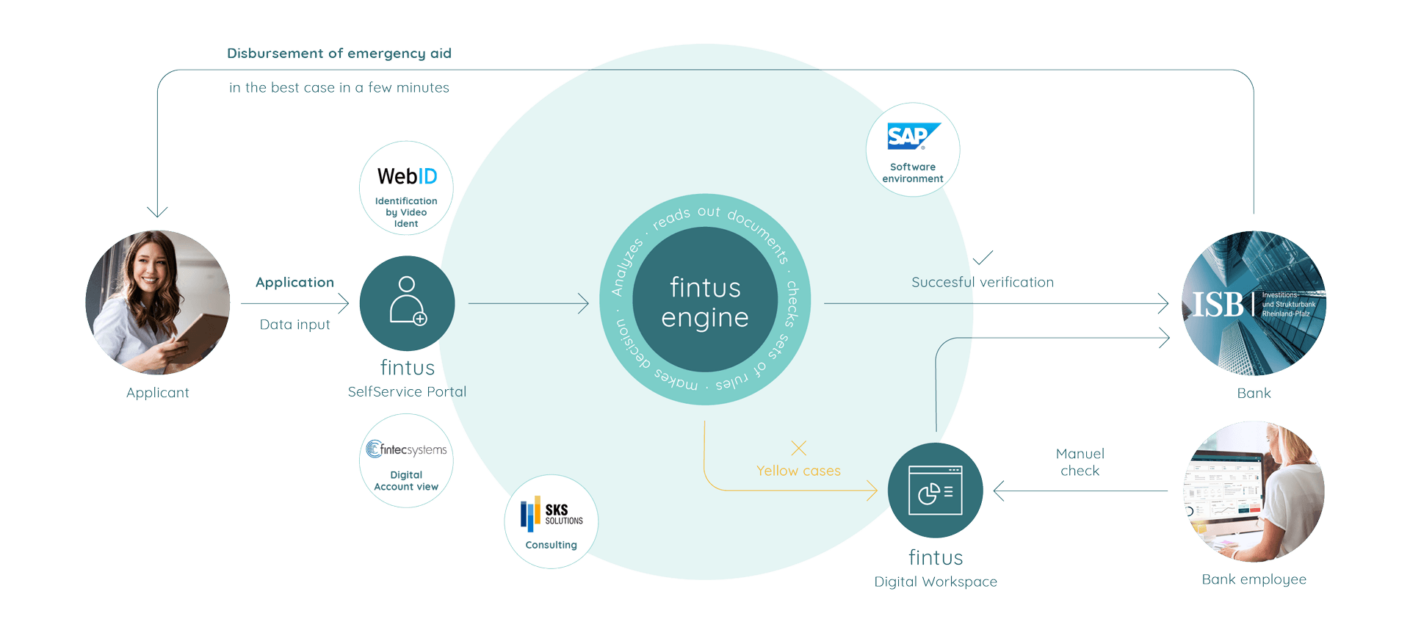

To achieve this, ISB cooperated with the SAP banking specialists at SKS Solutions, who leveraged fintus’ software platform and the partners from the fintus network, WebID and FinTecSystems, for implementation.

ISB’s challenge was to build a reliable application submission and processing solution in less than four weeks. The crisis situation did not offer a long conception or planning phase, but required decisive action and prompt implementation. The key requirement for the solution was that incoming applications could be processed quickly and reliably, so that the victims of the flood could receive the reconstruction aid with little processing time.

In addition, the collaboration of the partners involved had to be effectively orchestrated so that the strengths of the different companies could be productively incorporated into the overall project.

Amadeus von Kummer

Vice President Banking & Finance at FinTecSystems

In order to handle the high volume of incoming applications and to create an effective as well as simple workflow for victims, ISB worked with fintus to digitally implement the application path. In close cooperation with the project partners, a comprehensive solution was configured and the SelfService portal along with the application processing platform was implemented. After ministry´s decision and the requirements of the different funding programs, fast action was necessary and first steps were taken.

Here, the fintus low-code platform was able to showcase its core strength by enabling automated processes and decisions through its central control element. For this purpose, the fintus low-code platform was first integrated into the SAP system landscape of the ISB under the leadership of SKS Solutions and all necessary interfaces for the project were established. This integration formed the basis of the collaboration, as the other fintechs involved were also able to work on the joint solution in a straightforward manner via the fintus ecosystem that was created.

Vanessa Torno

Senior Managerin at SKS Solutions

With this approach, WebID and FinTecSystems were able to implement their services and lend important security standards to the digital application route. WebID ensured fully digital identification of the applicants. This is done using the Video-Ident service, an easy-to-perform online identification that meets the highest security level and is already familiar to citizens from other contexts, such as opening an account. FinTecSystems made a decisive contribution to reliably preventing fraud attempts with its digital account view.

The process of application and verification could be securely digitized and automated within a very short time. The SelfService portal was quickly opened to users, allowing flood victims from Ahrtal to apply for reconstruction aid. The applications were validated automatically and only forwarded to the ISB experts for further processing if necessary. By deciding early on to automate the process as best as possible, the entire process was able to run digitally and largely automated. The following steps could be automated thanks to the fintus low-code platform and therefore enabled a fast processing of the applications:

Frank S. Jorga

Founder and Co-CEO of WebID

The digitized and automated solution enabled the affected parties to submit an uncomplicated application, in which all important data and documents could be submitted digitally. The subsequent application processing was automated in the best possible way and resulted in fintus´ digital workplace – including the information from the video legitimation process and the digital account view for fraud prevention.

This not only optimized the speed of the application review, but also relieved the ISB staff. Thanks to fintus‘ digital workplace, all information was brought together in one interface and the internal coordination of task distribution was facilitated. The standardized processes as well as the automated processing of information from the applications and documents allowed the case workers to make individual decisions in a matter of moments.

This optimized processing of standardized applications enabled staff to devote more attention to cases that required manual consultation and processing due to a more complex overall situation. Given the highly emotional nature and the great importance of the application decision, special tact and an intensive discussions with the victims were often required here.

aid for Rheinland-Pfalz

for project implementation

in the processing of applications

Thanks to the trusting cooperation between the partners involved and the reliable orchestration provided by the fintus low-code platform, a highly integrated overall solution was set up within a very short time, enabling fast and reliable assistance for the flood victims in Ahrtal.

With fintus’ platform in place, a prompt decision on the applications as well as the rapid disbursement of the important funding was made possible. Fintus and its project partners are happy to have made an important contribution to local aid in this situation.

After this successful project, an intensification of the cooperation with the ISB is planned for the future. Among other things, the fintus low-code platform and the fintus ecosystem are to be further expanded. The reliable workflow and the optimization of the various work steps have convinced decision-makers and employees and will now be enabled for further projects.