Developing and/or configuring software using low-code platforms is also becoming increasingly popular in the financial sector. For its banking sector, IT service provider adesso has now entered into a partnership with fintus GmbH in Frankfurt. This will enable it to increase the benefits of a low-code banking platform for customers. The cooperation focuses on realizing optimisation potentials with the digital workplace of the future.

Dortmund/Frankfurt, 3 March 2022

adesso and fintus will jointly realize projects that involve introducing fintus’ low-code banking platform, which is already established in banks. The fintus Suite is a comprehensive banking and credit platform that can be quickly and flexibly integrated into practically any IT environment at financial institutions with the help of the implementation partner, adesso. Based on the open system architecture, any core banking systems, document management systems (DMS) and existing ERP/CRM systems at banks can be connected in the modern “look and feel” and processes can be consistently implemented. One advantage of low-code technology is the speed with which businesses can respond to changes in the market or new customer or regulatory requirements.

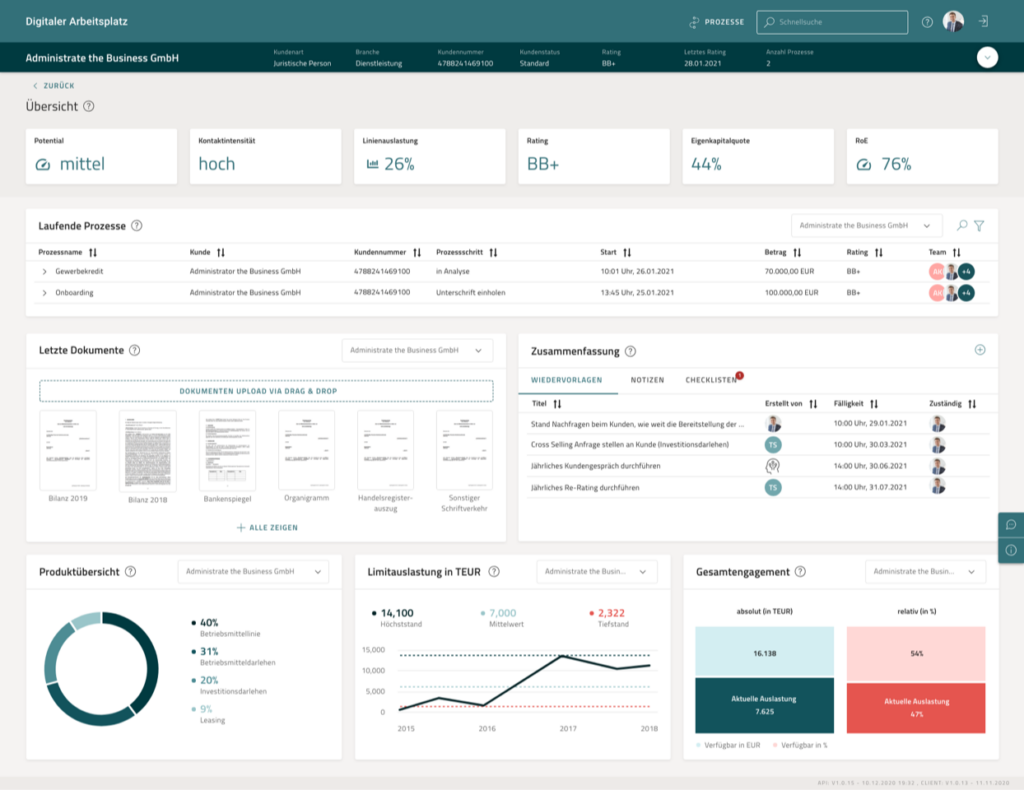

At the moment, adesso’s activity focuses on equipping the “digital workplace” with a comprehensive “all-round (360-degree) view” of all required data, documents, customers and tasks – from application processes and the subsequent tests as part of the origination process (“loan origination”), through the decision and digital contract completion, to account and deposit opening. Back office systems (usually core banking systems) are also linked by API and orchestrated by the fintus Suite.

Stephan Mecking, head of the banking division at adesso, developed the partnership with fintus: “In the industry, we are currently seeing that banks, especially in wholesale banking, are really struggling to create an environment where they can be competitive with the existing old IT systems. The fintus Suite has won us over on the market by being a modern, universal, end-to-end automation platform on a low-code basis. As an implementation partner, we are especially impressed by the integration capabilities of its high-performance process engine. At a time of digital transformation in the financial sector, banks can use it to create an important foundation for the flexible and evolving workplace of the future that they can then expand independently.”

Benjamin Hermanns, CEO and founder of fintus, believes that the partnership with an IT service provider like adesso, which has more than two decades of in-depth industry expertise, especially in the lending business, will really boost the offer on the market. “We are looking forward to being able to immediately get started on integration and implementation with an experienced international player like adesso. Our platform targets competitive and forward-thinking banks who would like support with human digitization of the world of work.”

The low-code platform from fintus enables a division such as the credit division to independently adapt and optimise processes and steps with intuitive interfaces and ready-made user masks, in a simple and time-saving way. Whether it’s setting up a new potential customer, adjusting credit or modelling securities and their approval processes – all of these functions can be conveniently configured by the division without necessitating costly, new, fundamental programming work in the IT department.

Further information about the low-code solution from adesso’s cooperation partner fintus is available at www.fintus.de.